Launching a legitimate business in Pakistan in 2025 involves more than a great idea and capital it requires following legal procedures and meeting regulatory requirements. Formal registration distinguishes a serious enterprise from an informal venture, unlocking opportunities for funding, partnerships, and long-term growth. This guide covers every step, from selecting the right structure to securing your National Tax Number (NTN), trade license, and tax registrations, using SECP’s eServices and FBR’s IRIS portal.

Why Register Your Business in Pakistan?

Registering your business is the first milestone towards credibility and compliance. It offers:

- Legal Protection: Incorporation shields personal assets, separating business risk from owner liability. Without registration, creditors can claim personal property.

- Credibility & Trust: Clients, suppliers, and banks prefer dealing with registered entities. A legal business name and official certificate can enhance a brand’s reputation.

- Tax Compliance & Incentives: Registration with FBR for NTN and STRN ensures you meet legal tax obligations, avoid penalties, and can claim input tax credits.

- Access to Funding: Only registered companies can issue shares, secure loans, or attract angel investors and VC funding. Banks require formal status for credit facilities.

- Long-Term Growth: A registered business can expand its operations, hire employees, and enter into contracts with confidence, knowing it meets all statutory obligations.

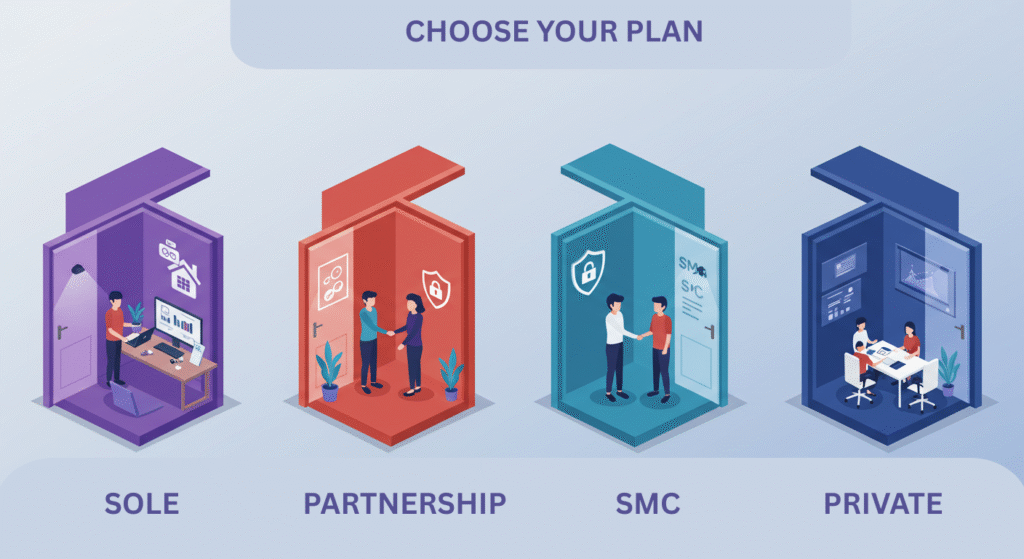

What Are Your Business Structure Options?

Choosing the correct legal form affects your liability, taxation, and future obligations. Pakistan’s main structures are:

| Structure | Description | Benefits | Drawbacks |

|---|---|---|---|

| Sole Proprietorship | Single owner controls all operations | Simplest setup, minimal costs | Unlimited liability; personal risk |

| Partnership / AOP | Two or more partners share profits/risks | Combined resources, shared decision-making | Joint liability, potential partner conflicts |

| Single‑Member Company (SMC) | One shareholder, limited liability | Asset protection; simpler compliance than Pvt Ltd | Annual audit if revenue exceeds the threshold |

| Private Limited Company | Multiple shareholders; limited liability | Best for scaling; easier to raise capital | Higher compliance and reporting requirements |

Compare these options by assessing your capital needs, risk tolerance, and growth plans. For freelancers or sole traders, proprietorship may suffice, while startups seeking investment often choose a Private Limited.

When Should You Register?

Timing your registration ensures you maximize benefits and avoid penalties:

- Before Generating Revenue: Registering before sales launches prevents fines for operating an unregistered entity under SECP and FBR rules.

- Before Hiring Staff: Employee payroll requires a valid NTN and registration to deduct tax at source and contribute to social security.

- Ahead of Funding Rounds: Investors and incubators mandate a formal legal entity to enter agreements and safeguard their investment.

- Before bidding on Projects, Government and corporate tenders require proof of registration, a valid NTN, and a trade license.

Planning registration around these milestones streamlines operations and builds confidence among stakeholders.

How to Reserve a Business Name (SECP)

Reserving your business name is the first formal step with SECP’s LEAP portal:

- Access SECP eServices (LEAP): Navigate to the company formation section on SECP’s website.

- Check Availability: Enter up to three proposed names; the system verifies against existing registrations and banned terms.

- Submit Application: Choose the approved name, fill out the reservation form, and pay the fee (PKR 1,000–2,000).

- Receive Provisional Approval: Typically issued within 1 working day, valid for 30 days to complete incorporation.

Tips:

- Avoid generic terms like “Pakistan,” “Global,” or names similar to government bodies.

- Include keywords relevant to your industry for SEO benefit in online searches.

How to Incorporate Your Company

Detailed steps for each structure ensure a smooth process:

Private Limited & SMC Registration

- Create LEAP Account: Register with your email and verify via OTP.

- Form‑A Submission: Provide company name, type, share capital, director details, and registered address.

- Required Documents: Upload legible copies of your Computerized National Identity Card (CNIC), a signed version of the Memorandum and Articles of Association, and your verified NADRA eSign certificate to authenticate digital submissions.

- Digital Signature Setup: If you haven’t already, register and activate a digital signature via NADRA eSign to enable secure online submissions.

- First Board Resolution: Hold the initial board (or shareholder) meeting, record the resolution approving incorporation, and upload the minutes where required.

FAQs

Q1: What legal entity works best for a new small business in Pakistan?

A: A sole proprietorship is often the go-to option for entrepreneurs seeking quick setup and low initial investment. If you’re looking for personal asset protection with fewer regulatory hurdles, a Single-Member Company (SMC) offers an excellent middle ground. If you’re looking for simplicity and low setup costs, a sole proprietorship is often the ideal starting point. For those seeking limited liability without extensive regulatory overhead, a Single-Member Company (SMC) strikes a good balance. For minimal setup and cost, a sole proprietorship works best; if you need liability protection without heavy compliance, consider a Single‑Member Company (SMC).

Q2: How long does it take to register a company with SECP?

A: Private Limited and SMC registrations typically complete in 3–5 working days, while Partnership/AOP registrations finish within 2–3 working days.

Q3: Is immediate sales tax registration necessary?

A: Only if your annual turnover crosses the FBR’s taxable threshold or you supply taxable goods/services. If your business doesn’t meet the sales tax registration criteria right away, prioritize obtaining your NTN and proceed with sales tax registration only when it becomes legally necessary.

Q4: Can I handle all registrations online without legal help?

A: Yes—as long as you follow SECP’s LEAP and FBR’s IRIS processes carefully. While it’s not essential to hire a professional, expert consultation can minimize errors and speed up the registration process.

Q5: What happens if I change my business address?

A: Update your registered address on both SECP and FBR portals within 30 days to stay compliant and avoid fines.

Q6: Can non-residents or foreign nationals launch a company in Pakistan?

A: Absolutely. Non-resident individuals are eligible to establish a Single-Member or Private Limited Company in Pakistan under SECP guidelines. They must provide key documents such as a valid passport and a notarized Power of Attorney, as required by SECP. They must submit required documents such as a valid passport and a notarized Power of Attorney. Foreign nationals can incorporate a Pvt Ltd or SMC, though they must also provide a Power of Attorney and passport copy.

Useful Resources & References

- SECP eServices (LEAP): Official portal for name reservation and company incorporation

- FBR IRIS System: The official government platform where businesses apply for NTN issuance and register for sales tax online

- Local Municipal Websites: Trade license applications by city

- Template Downloads: Memorandum & Articles of Association, Partnership Deed samples

Call to Action

Looking to build a compliant business from day one and unlock long-term growth potential? Reach out to Digzy Tech today for expert, end‑to‑end support on registration and taxation. Claim your free consultation and step‑by‑step checklist now!